Disclaimer:

This is not financial advice.

This is for information purpose only.

Hi everyone,

Here's an example of a systematic trading method using Donchian channel settings as base signalling (buy & sell signals) system.

It is described here in the context of spot long (non derivative crypto exchange "buy low & sell higher" altcoin for btc) trades.

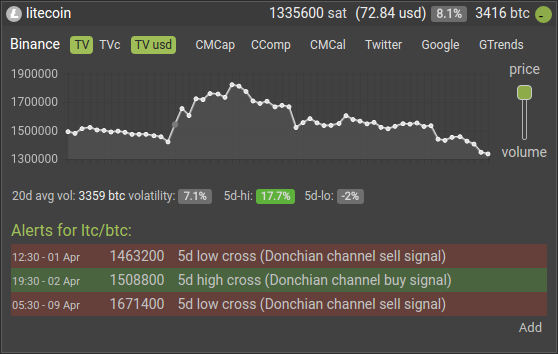

On the Litecoin/Bitcoin ($ltc/$btc) trading pair, suppose you

- bought at 1508800 satoshis (following our April 2nd 2019 "5 day high" break up alert)

- and then sold at 1671400 satoshis (following our April 9th 2019 "5 day low" break down alert),

you'd have a theoretical ~+10% profit, in Bitcoin (Btc).

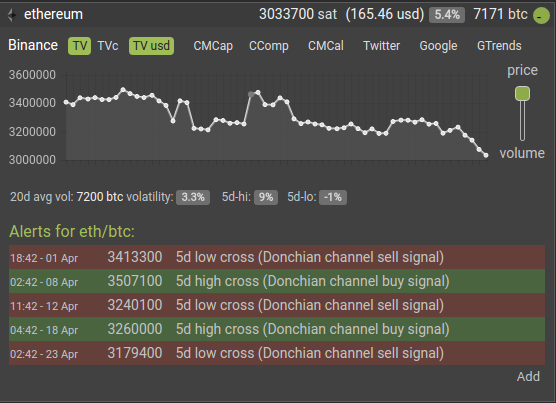

On the Ethereum/Bitcoin ($eth/$btc) trading pair, suppose you:

- bought at 3507100 satoshis (following our April 8th 2019 "5 day high" break up alert)

- sold at 3240100 satoshis (following our April 12th 2019 "5 day low" break down alert) for ~-8% loss

- bought at 3260000 satoshis (following our April 18th 2019 "5 day high" break up alert)

- sold at 3179400 satoshis (following our April 23rd 2019 "5 day low" break down alert) for ~-2.5% loss

you'd have a theoretical cumulative loss of ~-10%, in Bitcoin (Btc).

If you had commited the same bitcoin amount to each trading pair $eth's losses would have cancelled $ltc's gains.

Stop-losses & trailing stops to the rescue

One way to mitigate this could be to place stop loss orders to get out of trade before a "5 day low" break down alert is issued for that trading pair.

If you placed stop loss orders at -4% your buy average on each trading pair your $eth trades would have only caused a loss of ~-7%.

What could have you done to optimize your gains on the $ltc/$btc pair?

Let's say you applied this rule: If my position is in profit by more than +8% I apply a -4% trailing stop:

-4% from the first April '19 top at ~1850000 sat woudl have set an exit target at ~1770000 sat for a ~+17% profit on the $ltc/$btc pair.

Combining these two theoretical enhancements your overall profit would have been ~+10%.

Laddering, another way to mitigate risk: don't FOMO all-in!

What if you didn't commit the whole BTC amount (you intended for the trade) at any initial entry point?

Suppose you used this scheme (to partially buy altcoin amounts with multiple orders):

- first order: 1/3 overall amount at entry point

- 2nd order: 1/3 overall amount at entry point +3%

- 3rd order: 1/3 overall amount at entry point +6%

For Litecoin, your overall buy average would then be ~1554000 sat reducing your theoretical profit to ~+14%

For Ethereum, your losses would have been cut to ~-2.5%

This would have yielded a theoretical ~+11.5% profit overall.

Known caveats:

Each trading pair has its own rythm (most profitable "x time period high / y time period low" cycle) that changes across time.

The generic "5 day high / 5 day low" cycle (for which Donchian channel alerts are issued at Cryptocoin Radar) does not suit every trading pair optimally: this depends on each pair's history, volatility,...

There is no "one size fits all" setting that would be optimally profitable for each trading pair there is.

Like comparable trend trading strategies win rate might only be ~30% (or less) of all signalled entries: you need to be able to bear multiple losing trades with only few profitable ones.

Beware of "flash" price spikes that might get you out of trades too early: base your decision to enter or exit on at least 1 hour of price moving average, for instance.

This method may be costly (too much entries & exits draining portfolio) during flat markets.

Risk management tip: don't commit more than 2 or 5% of your portfolio per trade.

Past performance is not indicative of future performance.